3 Simple Techniques For Pacific Prime

3 Simple Techniques For Pacific Prime

Blog Article

The Pacific Prime Statements

Table of Contents3 Easy Facts About Pacific Prime ExplainedWhat Does Pacific Prime Mean?The 5-Second Trick For Pacific PrimeSee This Report on Pacific PrimeThe Best Strategy To Use For Pacific Prime

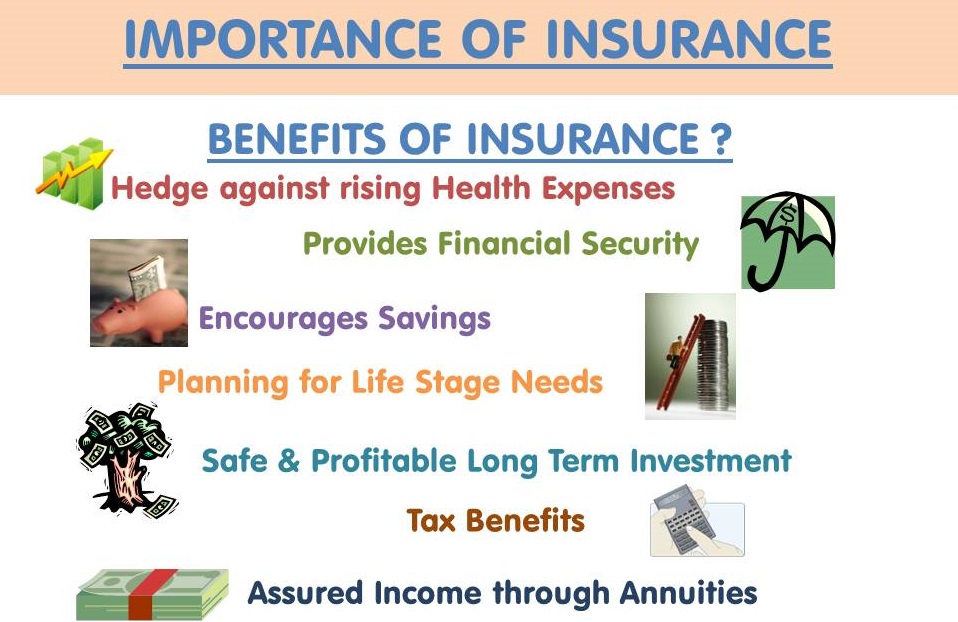

Insurance policy is an agreement, stood for by a policy, in which an insurance policy holder receives economic protection or reimbursement versus losses from an insurance provider. The business pools clients' dangers to make settlements extra affordable for the insured. The majority of people have some insurance coverage: for their automobile, their residence, their healthcare, or their life.Insurance policy likewise assists cover prices related to obligation (lawful responsibility) for damage or injury caused to a 3rd party. Insurance coverage is an agreement (policy) in which an insurer compensates another versus losses from certain contingencies or risks. There are many kinds of insurance coverage. Life, wellness, home owners, and car are amongst one of the most usual kinds of insurance coverage.

Investopedia/ Daniel Fishel Many insurance coverage types are offered, and essentially any kind of individual or service can discover an insurance provider willing to insure themfor a price. Usual individual insurance plan types are car, health and wellness, home owners, and life insurance policy. The majority of people in the USA have at least one of these kinds of insurance coverage, and cars and truck insurance policy is required by state law.

Pacific Prime Fundamentals Explained

So discovering the rate that is best for you requires some legwork. The policy limit is the maximum amount an insurance company will certainly pay for a covered loss under a policy. Optimums may be established per duration (e.g., annual or plan term), per loss or injury, or over the life of the policy, additionally referred to as the lifetime optimum.

There are several different kinds of insurance coverage. Health insurance coverage assists covers regular and emergency situation clinical treatment expenses, often with the choice to include vision and dental services individually.

Many preventative solutions may be covered for complimentary before these are satisfied. try this site Wellness insurance policy may be purchased from an insurance coverage firm, an insurance representative, the federal Health Insurance coverage Industry, offered by an employer, or federal Medicare and Medicaid coverage.

The Best Guide To Pacific Prime

The business after that pays all or many of the protected expenses associated with an auto accident or other automobile damage. If you have actually a rented vehicle or borrowed cash to acquire an automobile, your loan provider or renting dealer will likely require you to lug vehicle insurance coverage.

A life insurance policy policy warranties that the insurance company pays an amount of money to your recipients (such as a spouse or youngsters) if you die. In exchange, you pay costs during your life time. There are two main types of life insurance. Term life insurance coverage covers you for a details duration, such as 10 to twenty years.

Permanent life insurance coverage covers your whole life as long as you continue paying the costs. Traveling insurance policy covers the costs and losses related to taking a trip, consisting of trip cancellations or hold-ups, coverage for emergency health treatment, injuries and discharges, damaged luggage, rental autos, and rental homes. Nonetheless, also a few of the best traveling insurance policy business - https://www.evernote.com/shard/s546/sh/8f1cd5bd-5293-5c41-de17-4bdd133c2512/Ys4FLzdj5gxe0L6dvStII_pnIFGb0LUfGOCEfmyJ1KpgM_HY42MlBLvtpg do not cover terminations or hold-ups as a result of weather, terrorism, or a pandemic. Insurance coverage is a method to manage your monetary threats. When you acquire insurance policy, you purchase defense against unexpected monetary losses.

Some Known Factual Statements About Pacific Prime

There are several insurance coverage plan types, some of the most typical are life, health, house owners, and automobile. The appropriate sort of insurance for you will depend upon your objectives and economic situation.

Have you ever had a minute while looking at your insurance policy or shopping for insurance coverage when you've thought, "What is insurance policy? Insurance coverage can be a mystical and puzzling point. Just how does insurance coverage work?

Suffering a loss without insurance policy can put you in a challenging monetary situation. Insurance policy is a crucial financial device.

The smart Trick of Pacific Prime That Nobody is Discussing

And sometimes, like vehicle insurance coverage and workers' settlement, you might be required by legislation to have insurance in order to shield others - maternity insurance for expats. Find out about ourInsurance options Insurance coverage is essentially a massive rainy day fund shared by many individuals (called policyholders) and handled by an insurance service provider. The insurance coverage company uses cash accumulated (called costs) from its policyholders and various other financial investments to pay for its operations and to accomplish its promise to insurance holders when they sue

Report this page